gomyfinance.com create budget- A Comprehensive Guide!

Achieving financial freedom starts with mastering your budget. Whether you’re looking to pay off debt, save for a big purchase, or simply gain control of your finances, GoMyFinance.com offers user-friendly tools and expert insights to help you succeed. This platform is designed for individuals in the USA seeking effective strategies to track expenses, plan budgets, and achieve their financial goals.

In this article, you’ll learn how to get started with GoMyFinance.com, actionable budgeting tips, and how to use the platform to transform your financial life.

Why Does Budgeting Matters?

Creating a budget is essential for financial success. Here’s why it matters:

- Gain Financial Clarity: Understand exactly how much money is coming in and going out each month.

- Control Spending: Identify and eliminate unnecessary expenses.

- Achieve Goals: Allocate resources toward financial goals, such as buying a home or building an emergency fund.

- Reduce Stress: Knowing your financial situation helps reduce money-related anxiety.

How to Get Started with GoMyFinance.com?

Getting started with GoMyFinance.com is simple. Follow these steps:

Sign Up for an Account

- Visit GoMyFinance.com.

- Create a free account by providing your email and creating a secure password.

Input Your Income

- Enter all sources of income, including your primary job, side hustles, or passive income.

- This provides a clear picture of your monthly earnings.

List Your Expenses

- Categorize your expenses into fixed (e.g., rent, utilities) and variable (e.g., dining out, entertainment) expenses.

- Don’t forget occasional expenses such as car maintenance or holiday gifts.

Set Financial Goals

- Define both short-term and long-term goals.

- Examples include building an emergency fund, saving for a vacation, or paying off debt.

Track and Monitor Progress

- Use GoMyFinance.com’s tracking tools to monitor your spending habits.

- Adjust your budget as needed to stay on track.

Tips for Effective Budgeting – you should know!

- Be Realistic with Your Goals: Avoid setting goals that are too ambitious. Start small and build momentum as you see progress.

- Categorize Spending: Separate essential expenses from discretionary spending to better allocate funds.

- Automate Savings: Set up automatic transfers to your savings account to ensure you consistently save.

- Review Regularly: Revisit your budget at least once a month to accommodate any changes in income or expenses.

- Use GoMyFinance.com Tools: Take advantage of GoMyFinance’s features, such as spending analysis and goal tracking, to stay organized and motivated.

What are the Features of GoMyFinance.com?

- Budget Templates: Pre-designed templates make it easy to get started.

- Financial Analytics: Detailed reports provide insights into spending patterns and financial health.

- Goal Tracking: Set and track goals directly within the platform.

- Mobile Accessibility: Manage your budget on the go with a mobile-friendly interface.

How GoMyFinance.com Compares to Competitors?

| Feature | GoMyFinance.com | Competitor 1 | Competitor 2 |

| Budget Templates | ✅ | ❌ | ✅ |

| Financial Analytics | ✅ | ✅ | ❌ |

| Goal Tracking | ✅ | ✅ | ✅ |

| Mobile Accessibility | ✅ | ❌ | ✅ |

GoMyFinance.com stands out for its comprehensive features and user-friendly interface, making it a top choice for budget management.

Real-Life Success Story with GoMyFinance.com

Emily, a marketing professional from California, struggled to save money despite earning a decent salary. After signing up for GoMyFinance.com, she gained insights into her spending habits and realized she was overspending on dining out. By using the platform’s budgeting tools, she allocated a specific amount for dining and saved over $5,000 in a year. “GoMyFinance.com changed the way I think about money,” Emily shared.

READ MORE: Version Hazevecad04 Online -The Future of Productivity!

FAQs

How do I create a budget on GoMyFinance.com?

Simply sign up, input your income and expenses, set goals, and use the tracking tools to monitor progress.

Is GoMyFinance.com free to use?

Yes, the platform offers free tools to help users manage their finances effectively.

Can I track multiple income sources on GoMyFinance.com?

Yes, you can input multiple sources of income for a complete financial overview.

How secure is my financial information on GoMyFinance.com?

GoMyFinance.com uses advanced encryption technology to keep your data secure.

Can I access GoMyFinance.com on my smartphone?

Yes, the platform is mobile-friendly, allowing you to manage your budget on the go.

Conclusion

Creating a budget is the first step toward financial success. With GoMyFinance.com, you gain access to powerful tools and insights that make budgeting simple and effective. By setting goals, tracking expenses, and staying disciplined, you’ll be well on your way to achieving your financial dreams.

Ready to take control of your finances? Sign up for GoMyFinance.com today and start your journey to financial freedom. Share this article with friends and family who might benefit from better budgeting strategies!

READ MORE:

- How to Get the Perfect Light Brown Nails Color Backstageviral.com!

- PedroVazPaulo Human Resource Consulting – HR Solutions!

- 26100.1.240331-1435.ge_release_clientchina_oem_x64fre_zh-cn.iso!

You May Also Like

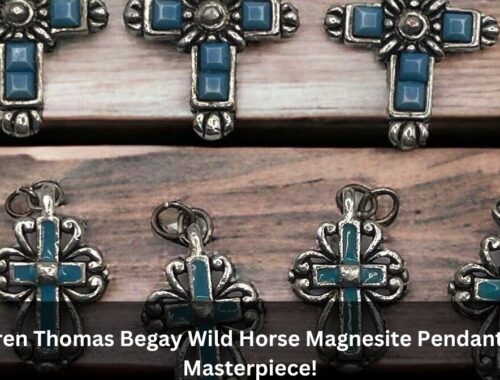

Loren Thomas Begay Wild Horse Magnesite Pendant- A Masterpiece!

January 13, 2025

HTTP 422 – The Evolution of HTTP Status Code 422

June 6, 2024

Average Rating